NEWSLETTER

|

|

Thank you for Signing Up |

The internet is a vast and wondrous place, filled with a plethora of information, entertainment, and opportunities for connection. Among the most popular content online are the irresistibly adorable videos of kittens and puppies. Who can resist the charm of a fluffy kitten chasing a laser pointer or a playful puppy tumbling around? However, as innocent as these videos may seem, there are hidden dangers associated with clicking on random cute animal videos. Here’s why seniors, in particular, should be cautious.

One of the primary concerns with clicking on random videos is the risk of malware and phishing attacks. Cybercriminals often use popular content, like cute animal videos, as bait to lure unsuspecting users. By clicking on a seemingly harmless video, you might inadvertently download malicious software onto your device or be redirected to a fake website designed to steal your personal information.

Many websites and platforms track user behavior, collecting data on the videos you watch, the links you click, and even the amount of time you spend on a particular page. Over time, this data can be used to create a detailed profile of your online habits, preferences, and interests. While some tracking is done for legitimate marketing purposes, there’s always a risk that your data could be sold or shared without your consent.

While it might start with one cute video, it’s easy to fall into a rabbit hole of endless related content. Before you know it, hours have passed, and you’ve accomplished little of what you set out to do. For seniors looking to make the most of their time, it’s essential to be mindful of how easily one can get sidetracked online.

Not all cute animal videos are created with pure intentions. Some are designed to tug at your heartstrings and manipulate your emotions for profit. For instance, videos that depict animals in distress, followed by a request for donations, can be misleading. While many legitimate organizations use this approach for fundraising, there are also scammers looking to take advantage of your compassion.

The internet is rife with misinformation, and animal videos are no exception. Some videos might promote incorrect care practices or perpetuate myths about certain breeds or species. For seniors who might be considering adopting a pet or looking for advice on animal care, it’s crucial to seek information from reputable sources.

Unfortunately, not all cute animal videos are as innocent as they seem. Some are produced under unethical conditions, where animals are mistreated or exploited for views and profit. By clicking on and sharing these videos, we inadvertently support and encourage such practices.

While the allure of cute kitten and puppy videos is undeniable, it’s essential to approach them with caution. The internet, like the real world, has its share of pitfalls and dangers. By being informed and vigilant, seniors can enjoy the wonders of the web without compromising their safety or well-being. Remember, it’s always better to be safe than sorry!

It is that time of year again! Medicare Annual Enrollment is from October 15 through December 7 of each year. During this time, for those already enrolled in Medicare, it is your time to review your plan and make changes if desired.

When I first started my career in the Medicare world, I realized there was a lot of new information I had to learn and found that breaking it down into bite-sized chunks made it much easier to understand. I started by focusing on all the different parts of Medicare.

Here is a breakdown of what I learned to help you understand how Medicare works.

Simply put, Medicare is a federal health insurance program for:

The Medicare program offers basic coverage to help pay for things like doctor visits, hospital stays and surgeries.

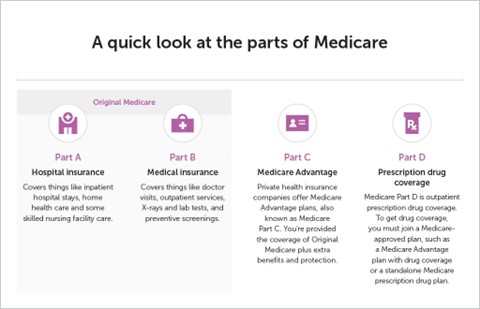

Medicare is broken into four parts.

Deductible: A set amount you may pay for covered services before your plan begins to pay.

Copay: A fixed amount you pay at the time you receive a covered service.

Coinsurance: A percentage of the cost you pay for a covered service.

I will give you a breakdown of your out-of-pocket exposure with just “Regular Medicare” as I break down what is and is not covered under each of Medicare’s parts below.

Part A (hospital coverage) covers things like inpatient hospital stays, home health care and some skilled nursing facility care. Together, Medicare Parts A and B are called Original Medicare.

Typically, most people don’t pay for Part A if they have paid Medicare taxes for a certain amount of time while working. However, if you don’t qualify for premium-free Part A, it can be purchased for a monthly premium. This amount may vary each year and is based on how long you or your spouse worked and paid Medicare taxes.

Deductible: $1,600 per benefit period defined as the day you are admitted to the hospital and when you have been out of the hospital 60 days in a row.

Copays: Days 0-60 in the hospital: $0, $400 per day days 61-90, $800 per day days 91+

Copays: $0 Days 1-20, $200 per day Days 21-100

Coinsurance: Home hospice patients may pay a small coinsurance amount for inpatient respite care or durable medical equipment used at home.

Copays: Copays during home hospice care may include up to $5 per prescription for pain and symptom management.

Note: With “Original Medicare,” there is no maximum out-of-pocket (MOOP)!

Part B (medical coverage) covers things like doctor visits, outpatient services, X-rays and lab tests, and preventive screenings.

The short answer is yes, especially if you’ll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouse’s active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working – whether it’s you or your partner – you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

No, you will pay a Premium in between $164.90 and $560.50depending on your tax reported income from two years prior. Medicare Part B is only free if you have a low income and are enrolled in one of the Medicare Savings Programs for financial assistance. Eligibility for these programs varies by state, and some states make it easier to qualify because of higher income limits or by eliminating the asset requirement.

Premium: $164.90 – $560.50 either deducted from your monthly Social Security check or that you may pay directly to Medicare.

Deductible: $226 per year

Coinsurance: 20% of covered services. You generally pay 20% of the Medicare-approved amount for the covered services you use, with no annual out-of-pocket maximum. Medicare pays the remaining 80%.

Part C is also known as Medicare Advantage. Private health insurance companies, like United Healthcare who I represent, offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare. These plans must provide the same coverage as Original Medicare (so you’re not missing out on anything). They can also offer extra benefits, including, but not limited to the following: part D prescription drug coverage, routine dental care, eye exams, eyeglasses or contact lenses, hearing exams or hearing aids, wellness benefits such as gym memberships.

Is Medicare Part C free?

Medicare Advantage Plans, including those offered by United Healthcare, are often premium-free.

Each plan varies and a Medicare professional, like me, can evaluate your current health and medication needs to determine which plans are best for your individual needs. Your exposure is generally considerably less with a Medicare Advantage plan.

Medicare Advantage Plans are required, unlike Original Medicare, to have annual maximum out-of-pocket deductibles. For 2024 plans offered by United Healthcare, some of these are as low as $3,400 (maximum “MOOP” limit set by Medicare in 2023 is $7,400) not including premium payments, drug costs, costs of extra services like vision or dental.

Many Medicare Advantage plans are coordinated care plans and contract with a network of doctors and hospitals. Some plans require you to choose a primary care provider from their network.

Part D covers prescription drugs. Only private insurance plans offer it. It’s usually included in a Medicare Advantage plan or you can get a separate Part D plan.

Though Medicare Part B does cover certain vaccines and medications (based on specific health conditions), Part D provides a much wider range of coverage of vaccines and outpatient prescription drugs. Premiums, deductibles, copays, and coinsurance vary by plan. For me, this is the most critical phase of selecting what Medicare product is best for your needs.

I chose to exclusively represent United Healthcare due to its stability as a Fortune 5 company, its vast network of over 1 million providers, and its consistently high customer service rankings. In my experiences, I have found that most people are best served, both from a financial and preventative health standpoint, are best served on a Medicare Advantage plan. Since they became available in 2003, they have vastly improved, most noticeably in that they did not use to travel well, but now they do.

Yes, Medicare and all of its options can be confusing and complicated. I am here to help you navigate your way through the Medicare maze. For now, I am licensed only in Ohio but will be adding Florida and Maryland within the next year. I would love to talk to you and help you with this process.

In today’s rapidly evolving technological landscape, the concept of smart homes and the Internet of Things (IoT) has transformed the way we perceive and interact with our living spaces. One such innovation that has garnered attention is the smart garage door opener, a device that promises enhanced security and unparalleled convenience, especially for our senior citizens. This article delves deeper into the world of smart options available for senior citizens, emphasizing the transformative potential of garage door openers.

As the global population ages, there’s an increasing emphasis on creating environments that cater to the unique needs of senior citizens. Aging often brings with it challenges related to mobility, memory, and overall physical well-being. In such scenarios, even a simple task like opening or closing a garage door can become cumbersome. This is where smart garage door openers come into play. By allowing seniors to control their garage doors remotely, these devices not only reduce physical strain but also address potential memory lapses, ensuring that homes remain secure.

A frontrunner in the smart garage door opener market, the Chamberlain MyQ Garage Hub stands out for its simplicity and efficiency. Installation is a breeze, and its companion app, MyQ, is designed with user-friendliness in mind. Seniors can receive real-time notifications if their garage door is left open and can close it with just a tap, no matter where they are. This not only ensures their safety but also provides immense peace of mind to their loved ones.

Genie’s Aladdin Connect is more than just a garage door opener; it’s a comprehensive security solution. Apart from its primary function of opening and closing the garage door remotely, it maintains a detailed log of door usage. This feature is particularly useful for caregivers and family members, allowing them to monitor any unusual or unexpected activity, ensuring the senior’s safety.

Nexx Garage’s smart opener is a testament to the power of integration. Compatible with a wide range of existing garage door openers, it also syncs seamlessly with popular smart home ecosystems like Alexa and Google Home. This interconnectedness ensures that seniors can use voice commands to control their garage doors, making the process even more effortless. Additionally, the option to share access means caregivers can step in and assist whenever necessary.

LiftMaster’s range of smart garage door openers is a blend of innovation and reliability. With built-in Wi-Fi capabilities, these openers can be controlled via smartphones. Features like Battery Backup ensure functionality even during power outages, while Security+ 2.0 offers an added layer of protection against unauthorized access. For seniors, this translates to a hassle-free and secure experience.

The advantages of smart garage door openers extend beyond the senior users. For families and caregivers, these devices offer a new dimension of support. The ability to monitor the garage door’s status in real-time, coupled with historical data, ensures that they are always in the loop regarding the senior’s activities. This proactive approach to caregiving, facilitated by technology, ensures timely interventions and fosters a sense of security.

As we look to the future, the integration of technology into senior care is not just desirable but essential. Devices like smart garage door openers are just the tip of the iceberg. From wearable health monitors to AI-powered home assistants, the potential is immense. By embracing these innovations, we can create living environments that are not only safe and secure but also empower seniors to lead fulfilling, independent lives.

The advent of smart garage door openers is a testament to how technology can be harnessed to enhance the quality of life for senior citizens. As we continue to innovate, it’s crucial to ensure that these advancements remain accessible and user-friendly, paving the way for a brighter, safer, and more connected future for our elderly population.

Hello, fellow wanderlusters! 🌍✨

Traveling is more than just visiting new places; it’s about the experiences, the people, the stories, and the memories we create. And what better way to cherish these memories than by documenting them? Whether you’re a seasoned traveler or just starting your journey, keeping a record of your adventures can be a rewarding experience. Let’s explore the why and how of travel documentation.

A travel journal is a timeless way to document your journey. Here’s how to make the most of it:

In today’s digital age, photography is more accessible than ever:

Share your journey with a wider audience:

Platforms like Instagram, Facebook, and Twitter allow you to share snippets of your journey instantly:

For those who love hands-on projects:

For those who prefer speaking over writing:

In conclusion, documenting your travel journey is a deeply personal and enriching experience. It’s a way to relive the magic of travel, to learn from your experiences, and to share your stories with the world. Whether you choose pen and paper, a camera, or a microphone, the key is to capture the essence of your journey. So, on your next adventure, remember to take a moment, document, and cherish the memories for a lifetime. 🌟🌍📖

Hello there, adventurous souls! 🌍

So, you’ve just retired, and the world is your oyster. The kids have flown the nest, and you’ve got time on your hands. You’ve always dreamt of traveling, but perhaps you’ve never had the chance, or maybe you’ve always traveled with family. Now, it’s time for a new chapter: solo traveling. And guess what? It’s going to be fabulous!

Before you jet off to a faraway land, consider taking a few short trips closer to home. This will give you a feel for solo traveling without the added stress of being in a completely unfamiliar environment. Visit a nearby town, take a weekend getaway, or even just a day trip. Explore local museums, parks, or new eateries you’ve never tried before. Once you’re comfortable, the world is yours to explore!

While you’re off exploring, you’ll want peace of mind knowing your home is safe and sound. Here are some steps to ensure that:

If you have pets, their well-being is a top priority. Here are some options:

While solo travel is about independence, it’s essential to keep your loved ones informed:

Now, for the fun part! Research destinations that interest you. Read blogs, watch travel videos, and join online travel communities. Remember, this is your journey, so go where your heart desires.

Pack light but efficiently. Remember, you’ll be the one carrying your luggage, so make it manageable. Invest in a good quality, lightweight suitcase. Prioritize essentials and think about multi-functional items. Don’t forget medications, comfortable shoes, and any special requirements you might have.

Traveling alone doesn’t mean being lonely. Embrace the freedom! Eat where you want, visit the places you’re interested in, and set your own pace. Be open to meeting new people, but always prioritize your safety. Join local events or community gatherings to immerse yourself in the culture.

Safety is paramount. Always let someone know where you’re going. Avoid risky areas, especially at night. Keep your belongings secure and be wary of scams targeting tourists. Always trust your instincts.

Start a travel journal or blog. Documenting your experiences is a wonderful way to reflect and share your adventures with family and friends. Capture photos, jot down memories, and collect mementos.

Lastly, and most importantly, enjoy every moment. This is your time. Soak in the sights, the sounds, the flavors, and the experiences. Make memories that will last a lifetime.

In conclusion, solo traveling as a newly retired senior citizen is not just a possibility; it’s a thrilling adventure waiting to happen. With the right preparations and a positive attitude, the world is truly at your fingertips. So, put on those walking shoes, grab your passport, and embark on the journey of a lifetime. Safe travels and happy adventures! 🌟🌍🌟

When our thoughts wander to caregiving for seniors, the spotlight often falls on the elderly individuals who require assistance, be it physical, emotional, or medical. But what about the caregivers themselves? These unsung heroes of senior care carry the enormous responsibility of another person’s well-being on their shoulders. Ironically, in fulfilling this role, their own health and happiness often take a backseat. In caregiving, compassion and support should be a two-way street.

The Physical Strain and Ergonomic Solutions: More Than Just Heavy Lifting

When we think about caregiving, we often underestimate the physical aspects involved. From lifting the elderly to assisting them in day-to-day activities like bathing and eating, caregivers are engaged in physically demanding tasks. The long-term effect of this physical strain can be debilitating, leading to chronic physical conditions like back pain, fatigue, and even injuries.

Solution: To alleviate physical strain, families should consider investing in ergonomic solutions. From lift chairs and adjustable beds to specialized mobility aids, these devices can be game-changers for caregivers. Furthermore, a rotating schedule among family members can help relieve the primary caregiver, allowing for necessary breaks to recover physically.

Emotional Support, Respite Care, and Mental Health Days

The emotional and mental toll of caregiving is often underestimated. Continuous caregiving can lead to burnout, manifesting as feelings of being overwhelmed, isolated, and emotionally drained.

Solution: Regular emotional check-ins are crucial. For professional emotional support, engaging a therapist or counselor specialized in caregiver stress can be incredibly beneficial. Temporary respite care services can offer the caregiver a well-deserved break, allowing them to recharge emotionally and mentally. Giving caregivers occasional mental health days where they have no responsibilities can also be empowering.

Financial Security: More Than Just Pocket Change

Financial strain is another hidden facet of caregiving. Full-time family caregivers might have to quit their jobs, while even part-time caregivers face limitations on their work hours.

Solution: Monetary compensation is a tangible way to value the caregiver’s time and effort. Families should pool resources to offer the caregiver a stipend, or if possible, cover additional expenses such as transportation and meals. Financial planning should be a part of the caregiving conversation, and consulting a financial advisor specialized in caregiving scenarios can provide valuable insights.

Legal Clarity: Safeguarding Rights and Responsibilities

Legal responsibilities and rights can be overwhelming to navigate, especially when it comes to making decisions about healthcare, finances, and property management for the senior.

Solution: A consultation with an elder care attorney can safeguard both the senior’s and the caregiver’s interests. Legal clarity is essential in a caregiving arrangement to prevent future conflicts and protect everyone involved.

Skill Training: Empowering Caregivers

While professional caregivers come equipped with specialized skills, family caregivers often have to learn on the go. This can be a source of stress and insecurity.

Solution: Skill development workshops and training programs can offer caregivers the tools they need to excel in their roles. These could range from CPR training to specialized care routines for conditions like Alzheimer’s or dementia.

Membership Benefits and Experiences: Little Luxuries Matter

A membership to a spa or massage facility can offer caregivers a sanctuary to relax and recharge. Other little luxuries like annual passes to museums, cultural events, or a monthly subscription to a gourmet food or book service can make a significant difference in the caregiver’s quality of life.

Solution: Think about the caregiver’s interests when selecting memberships or experiences. Personalized gifts like these can make caregivers feel cherished and valued, improving their emotional well-being and, by extension, their caregiving.

Communication and Appreciation: Words Matter

Open channels of communication ensure that the caregiver’s challenges, concerns, and needs are addressed effectively. Recognition for their hard work, perhaps in the form of a ‘Caregiver of the Month’ award or public acknowledgment among family and friends, can provide much-needed moral support.

Solution: Regular family meetings focused on the caregiver’s experience can offer a platform for open dialogue. Celebrating milestones or even day-to-day achievements can boost the caregiver’s morale significantly.

Caregivers are, without a doubt, the backbone of quality senior care. Their physical, emotional, and financial well-being directly impacts the level of care they can offer. By acknowledging and addressing their needs, we can close the loop in the caregiving cycle, making it more sustainable and fulfilling for everyone involved.

Through targeted physical support, emotional nourishment, financial security, legal safeguards, skill development, and the addition of small luxuries, families can elevate the caregiving experience. When caregivers are well-cared-for, they are in a better position to offer high-quality care, completing the cycle of care that benefits our seniors most of all.

In today’s fast-paced world, the values and priorities of different generations often diverge significantly. One noticeable difference lies in the contrasting preferences of senior citizens, who tend to cherish possessions and collections, and younger generations like Millennials and Generation Z, who prioritize experiences over ownership. Let’s explore the underlying reasons why senior citizens find it so important to own collections of things, while younger generations gravitate toward accumulating memories and experiences. Through a comprehensive analysis, we’ll uncover the historical, psychological, and sociocultural factors that shape these generational distinctions.

The Legacy of Possessions

Senior citizens grew up in an era where possessions held immense significance. They lived through times of scarcity, economic hardship, and world-changing events such as the Great Depression and World War II. These experiences shaped their attachment to physical belongings as a source of security and stability.

Possessions often carry sentimental value. Senior citizens collect items like antiques, family heirlooms, and memorabilia that connect them to their past. These collections serve as tangible reminders of cherished memories and loved ones, fostering a sense of continuity and comfort.

The Pursuit of Experiences

Millennials and Generation Z face a different economic reality. High levels of student debt, housing costs, and job instability have influenced their choices. They prefer to allocate resources towards experiences like travel, dining, and events that offer a temporary escape from financial pressures.

Younger generations are more inclined towards minimalism, valuing a clutter-free and mobile lifestyle. Owning fewer possessions allows for flexibility, making it easier to relocate for job opportunities and travel experiences. Minimalism is also seen as environmentally responsible, aligning with concerns about sustainability.

The Psychology of Ownership

Senior citizens may experience the “endowment effect,” a psychological phenomenon where people overvalue what they own. Possessions can bring a sense of accomplishment and identity, making it harder to part with them.

In contrast, Millennials and Generation Z view experiences as investments in personal growth and well-being. They believe that the memories created through travel and adventures are more enriching and enduring than material possessions.

The Influence of Technology

Today’s technology has provided new avenues for collecting. Senior citizens may collect physical items, while younger generations engage in collecting digital assets like cryptocurrencies, NFTs (non-fungible tokens), and virtual goods in video games.

Social media platforms allow Millennials and Generation Z to share their experiences with a global audience instantly. The act of sharing becomes a part of the experience, reinforcing the preference for experiences over possessions.

Bridging the Generational Gap

It is crucial for each generation to understand and respect the values and choices of the other. Senior citizens can appreciate the pursuit of meaningful experiences by younger generations, while younger individuals can recognize the importance of possessions in preserving memories and legacies.

Finding a balance between owning possessions and seeking experiences can provide the best of both worlds. Senior citizens can downsize their collections to free up resources for travel or other experiences, while younger generations can appreciate the value of meaningful possessions.

In a world marked by rapid change, generational differences in values and priorities are to be expected. Senior citizens’ attachment to collections of possessions reflects their historical context and the significance of tangible memories. On the other hand, Millennials and Generation Z are drawn to the richness of experiences as a response to their economic realities and a desire for a more flexible and environmentally conscious lifestyle. Both perspectives have their merits, and understanding and appreciating these differences can foster intergenerational harmony and shared wisdom.

Hey there, fabulous readers of TheHipSenior.com! Are you tired of scrolling endlessly through Netflix, only to end up watching the same old reruns? Well, fret no more! We’ve curated a list of the top 10 movies that every senior over 55 should watch. Trust us, these films are more than just a way to pass the time; they’re a journey through emotions, life lessons, and pure entertainment.

Why You Should Watch It: This movie is a timeless classic that delves into themes of hope, friendship, and redemption.

Life Lesson: No matter how grim things look, never lose hope.

Why You Should Watch It: A heartwarming tale of an unlikely friendship between an elderly woman and her chauffeur.

Life Lesson: It’s never too late to break down social barriers and form new friendships.

Why You Should Watch It: This movie beautifully captures the essence of family dynamics and aging.

Life Lesson: Cherish the time you have with your loved ones; it’s more valuable than gold.

Why You Should Watch It: A sci-fi flick that’s not just for the grandkids! It explores the concept of eternal youth.

Life Lesson: Age is just a number; it’s how you feel inside that counts.

Why You Should Watch It: A story of friendship that transcends time, age, and even death.

Life Lesson: True friendships are eternal; they never fade away.

Why You Should Watch It: Two terminally ill men break out of a cancer ward and head off on a road trip with a wish list of to-dos before they die.

Life Lesson: It’s never too late to live your dreams.

Why You Should Watch It: A tearjerker that revolves around the bond among a group of Southern women.

Life Lesson: Through thick and thin, friendships can get you through anything.

Why You Should Watch It: An animated film that’s not just for the little ones. It’s a touching story about fulfilling lifelong dreams and new beginnings.

Life Lesson: Adventure is out there, no matter your age.

Why You Should Watch It: A 70-year-old widower becomes an intern at an online fashion retailer and forms an unlikely friendship with its young CEO.

Life Lesson: You’re never too old to start anew.

Why You Should Watch It: A man with a low IQ has accomplished great things in his life and been present during significant historic events.

Life Lesson: Life is like a box of chocolates; you never know what you’re gonna get.

These films are not just about entertainment; they’re about life itself. They tackle themes that we, the fabulous 55+ crowd, can relate to—friendship, love, dreams, and the sheer joy of living. So, grab your popcorn, snuggle up on the couch, and let these movies take you on a rollercoaster of emotions.

Loved our list? Don’t keep it to yourself! Share this article with your friends, family, and even your neighbor’s dog if he’s into movies. Let’s make this go viral, people!

What’s your go-to movie that didn’t make our list? Drop a comment below and let us know. We’re all ears!

In an age where almost everything is digitized and information is just a click away, Social Security fraud has emerged as a growing concern. Your Social Security number (SSN) is more than just a government identifier—it’s a key that can unlock a multitude of services, accounts, and benefits. As such, protecting it is critical. This article aims to provide you with a comprehensive guide on how to avoid falling victim to Social Security fraud.

Before we dive into preventive measures, let’s first define what Social Security fraud entails. It can be as simple as someone using another person’s Social Security number to gain unauthorized access to benefits or as complex as elaborate schemes designed to divert funds from Social Security accounts. This fraud is not only damaging to the individual but also has broader societal implications by putting pressure on an already strained system.

Being proactive is key to safeguarding your Social Security information. This involves a combination of physical security measures and digital precautions. A little bit of vigilance can go a long way in keeping your data secure.

Credit monitoring services can provide real-time alerts if someone tries to open an account in your name. Some services even offer specialized Social Security monitoring features. Make sure to shop around and read reviews before choosing a service that fits your needs.

Time is of the essence if you suspect you’re a victim of Social Security fraud.

Often, older adults are targeted for Social Security fraud. Make sure to educate your parents, grandparents, or any elderly individuals in your life about the risks and preventive measures.

Technology and tactics used by criminals are always evolving, so it’s crucial to stay updated on new forms of fraud and how to combat them. This can involve subscribing to newsletters from trusted organizations that provide updates on security measures, fraud tactics, and what to do if you find yourself a victim of such schemes.

In today’s interconnected world, the risk of Social Security fraud is higher than ever before. However, this should not induce panic. By taking robust preventive measures and being vigilant, you can significantly minimize the risk of falling victim to such fraud.

Remember, Social Security fraud does not just affect you; it affects the broader social fabric by straining resources meant to provide a safety net for all. By taking steps to protect yourself, you’re also contributing to the integrity and sustainability of the system as a whole.

So, take action today: secure your documents, update your passwords, educate your loved ones, and remain vigilant. A secure future is a collective responsibility.

Protecting yourself from Social Security fraud is a multi-step, continuous process, but the peace of mind it offers is invaluable. With informed choices and proactive steps, you can contribute to making Social Security a more secure and reliable social institution for everyone.

In the last few decades, a new term has gained prominence in the landscape of love and matrimony: “gray divorce.” This phrase, contrary to its somewhat gloomy undertone, represents the growing phenomenon of middle-aged people ending their marriages. While the stigma surrounding divorce has diminished, it has left many of us pondering: Why are couples who have spent decades together deciding to go their separate ways?

One of the most glaring misconceptions is that couples who have weathered the storms of early marriage are in it for the long haul. Society paints a picture of the golden years filled with companionship, leisurely travel, and rocking chairs side by side. The reality can be jarringly different. When retirement rolls around, couples suddenly find themselves confronting not only a new lifestyle but also their own expectations of what those golden years should look like. It’s a reality check that can shake the very foundation of a marriage.

For many, parenting provides a shared goal that keeps the marital engine running. Household chores, school activities, and weekend soccer games offer a well-oiled routine. However, once the kids move out, couples often find themselves staring at each other across an empty nest, wondering what’s left to share. The absence of a common goal can expose cracks in the relationship that were easy to overlook when parental duties consumed all the attention.

Personal growth isn’t linear, and it certainly doesn’t stop as we age. Over the years, both partners continue to evolve, develop new interests, and sometimes, outgrow old ones. While change is a sign of a healthy, introspective life, it can also lead to a gradual drifting apart if both parties aren’t growing in the same direction. By the time they reach middle age, some spouses realize they have become fundamentally different people with diverging life goals, leading to the difficult decision to separate paths.

Believe it or not, the prospect of newfound freedom can be exhilarating. This isn’t about experiencing a mid-life crisis but rather an awakening. With longer life expectancies and better health in the later years, many see this period as an opportunity for a fresh start—a second act, so to speak. With the children grown up and fewer financial constraints, they seek new experiences, whether it’s travelling the world, picking up a long-forgotten hobby, or even finding a new romantic partner more aligned with who they have become.

Perhaps, the most significant factor fueling the rise in middle-aged divorce is the lifting of the social taboo surrounding it. The idea of ‘staying together for the kids’ or societal appearances is less influential than it was a few decades ago. Social media platforms are awash with narratives of people finding happiness post-divorce, offering both a support system and proof that life can flourish after separation.

As the concept of success is redefined in the modern age, so is the concept of a successful marriage. Many no longer see longevity as the only metric for a happy marriage. Rather, authenticity and individual happiness have taken the center stage. When the weight of the unspoken, accumulated disappointments reaches a tipping point, couples may choose to take separate routes in the quest for a more authentic life.

In a world where second chances are not only possible but also socially acceptable, the trend of middle-aged divorce becomes less of an enigma. This phenomenon isn’t necessarily a reflection of failure but often an act of courage—an opportunity to make the remaining years not just bearable, but truly meaningful.